Cost of Living in Flower Mound, Texas: What Families Actually Pay Each Month

Watch: Cost of Living in Flower Mound, Texas — Real Monthly Budget for Families (2026)

Thinking about moving to Flower Mound, Texas? In this in-depth video, we break down the true cost of living in Flower Mound for families — including home prices, property taxes, HOA fees, utilities, commute + toll costs, groceries, and childcare expenses. If you’re relocating to the Dallas–Fort Worth (DFW) area and want to know what you’ll realistically spend each month, this Flower Mound cost guide will help you plan with confidence.

If you’re researching the cost of living in Flower Mound, Texas, you’re probably already seeing it show up on “best places to live” lists — and for good reason. Flower Mound is known for high-performing schools, strong safety, and an upscale suburban lifestyle with quick access to DFW Airport, Dallas, Fort Worth, Plano/Frisco, and Southlake.

But let’s be real: that quality of life isn’t free.

In this guide, I’m going to break down the true Flower Mound cost of living—housing, taxes, utilities, commuting, groceries, childcare, and the “hidden costs” families don’t always plan for.

Flower Mound Cost of Living Snapshot (The Short Version)

Flower Mound tends to cost more than many surrounding DFW suburbs mainly because of home prices + property taxes, and then the rest of life stacks on top.

Here’s the quick expectation-setting:

Most relocating families shop in the high $500Ks to low $800Ks (with outliers based on neighborhood + schools + commute + new build vs resale).

Median home values/sale prices float around the mid-$500Ks to $600Ks+ depending on the dataset and month.

Utilities and commuting can vary wildly depending on lawn watering, pools, and toll road usage.

Housing Costs: The Biggest Driver of Flower Mound Cost of Living

Home prices (what you should budget for)

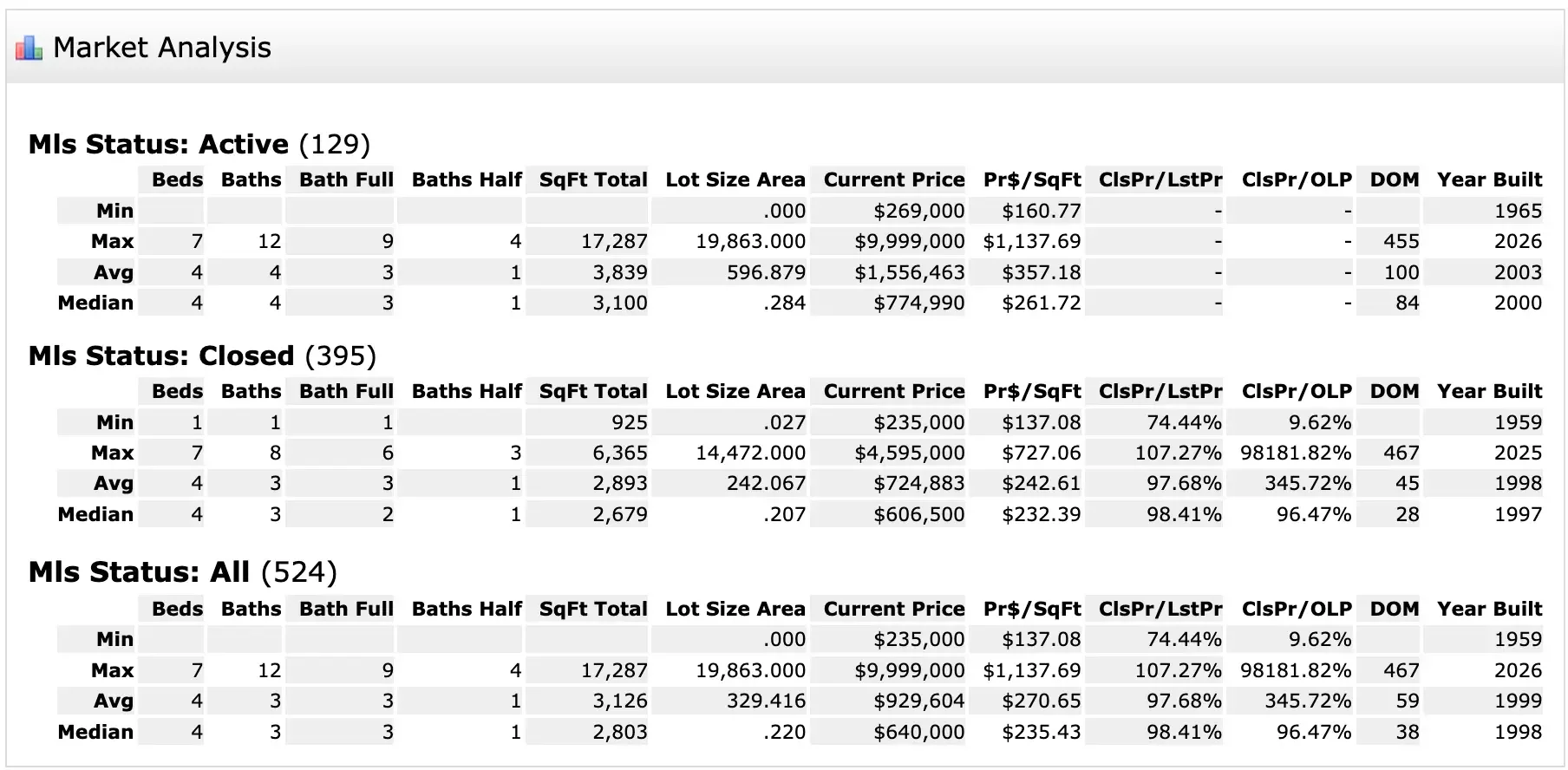

Flower Mound is not a “starter-home” town in the way some other suburbs are. Most families moving here are aiming for space, schools, and lifestyle, and that’s reflected in prices. You may note below the average sales price is much higher than the median, this is due to the wide range of sales prices and that make up the Flower Mound Texas housing market. Below is a market analysis for the Flower Mound Texas housing market showing the range of active listings, and closed sales in the past 180 days as of January 2026. So as you can see there is a huge range of home prices available in this popular suburb in Dallas Texas.

Flower Mound Texas January 2026 Market Analysis

Depending on timing and market conditions, you’ll see data sources report:

Average home value around the mid $700Ks

Median sale price ranging roughly from mid-$500Ks to $600Ks+ depending on the month

Search for homes for sale in Flower Mound Texas!

Mortgage payment reality check (why this matters)

Even small interest rate changes swing monthly payments dramatically. So when you’re budgeting the “cost to live in Flower Mound,” don’t just look at home price—look at:

principal + interest

property taxes

homeowners insurance

HOA (if applicable)

utilities (electricity in Texas can be sneaky)

In other words… your true monthly payment is usually far higher than the mortgage quote.

Property Taxes in Flower Mound: The “DFW Cost” Families Underestimate

Texas doesn’t have a state income tax, but we definitely fund life through property taxes.

If you want to run some calculations on possible homes you are considering, you can use the Denton County Property Tax Estimator to give you a ballpark number of what your annual property tax bill may be.

Flower Mound town property tax rate

Flower Mound property taxes are a major part of the overall cost of living in Flower Mound, Texas, and it’s important for relocating families to understand how the bill is calculated. Texas has no state property tax, so property taxes are assessed and used locally to fund services like police, fire, streets, utilities, parks, and recreation. The Town of Flower Mound’s current property tax rate is $0.387277 per $100 of home value, but your total rate will typically be higher because your final bill also includes other taxing entities such as Denton County or Tarrant County (depending on your address) and Lewisville ISD, along with any other applicable local districts. The good news is Flower Mound has aggressively expanded tax relief for homeowners through its homestead exemption, and as of June 2025, the Town increased its exemption to the greater of $5,000 or 20% of value (the highest level allowed for a Texas municipality), which takes effect on 2025 property tax bills and can significantly reduce the taxable value of your primary residence if you qualify.

School district taxes (Lewisville ISD)

Much of Flower Mound is served by Lewisville ISD, and LISD lists a total tax rate of $1.1178 per $100 valuation.

Important: Your total property tax bill isn’t just “Flower Mound + LISD.”

It can include county taxes, other entities, and your specific home’s valuation + exemptions.

Denton County tax rate (context)

Denton County’s adopted tax rate for FY 2025–2026 is reported as $0.185938 per $100, and official county communications confirm the decrease.

Homestead exemption (big money saver)

Texas homeowners may qualify for a homestead exemption, and Texas voters approved an increase in the school district homestead exemption from $100,000 to $140,000 starting in tax year 2025.

That can reduce the taxable value used for school district taxes, which often makes up a large share of your bill.

Flower Mound vs. newer suburbs (MUD/PID factor)

One financial advantage of Flower Mound is that it’s an established suburb, and most neighborhoods don’t have MUD or PID “add-on” taxes like you’ll see in many newer master-planned areas.

That said, there’s ongoing development on the west side, and it’s worth watching how future neighborhoods structure taxes.

HOA Fees in Flower Mound: From $0… to Luxury Tower Levels

HOA fees in Flower Mound, Texas can vary a lot depending on whether you’re buying in a traditional single-family neighborhood, a townhome community, or a luxury condo near Lakeside. For most families purchasing a standard single-family home in Flower Mound, HOA dues typically fall in a realistic range of about $500 to $1,200 per year (roughly $40 to $100 per month), with the higher end usually applying to neighborhoods that maintain community amenities like pools, trails, playgrounds, entrances, landscaping, and common-area upkeep. Some well-known Flower Mound communities land right in this range—for example, Wellington is around $990 per year, and neighborhoods like Bridlewood are in the same general ballpark with dues starting around $1,100 per year.

If you move into a townhome-style community, HOA dues are often higher because the association may cover more shared maintenance and exterior responsibilities, and it’s common to see monthly dues around the $200 to $300 per month range. At the top end of the spectrum, Flower Mound also has luxury condo options—especially in the Lakeside area—where HOA fees can jump significantly due to building operations, amenities, maintenance, and shared services. In these luxury condo towers, it’s realistic to see HOA dues ranging from roughly $750 per month and, in some cases, $2,000 to $3,700+ per month, depending on the unit and level of services provided.

Utilities in Flower Mound: What You’ll Pay Monthly

Utilities are one of those things people assume will be stable… until summer hits and Texas laughs.

Water + sewer + trash

A typical household can expect:

$70 to $120 per month for water/sewer/trash

Costs swing based on:

lawn watering

whether you have a pool

seasonal usage (summer = the boss level)

Internet

Most families budget:

$60 to $90 per month for high-speed internet

Electricity (Texas deregulated market)

Electricity pricing in North Texas changes fast, but a helpful planning range is:

Dallas area average around 14.32¢/kWh and ~$157/month at 1,000 kWh usage tier

Many forecasts put Texas electricity rates roughly 14–19¢/kWh depending on plan structure and timing

Pro tip: the “cheap rate” you see online can be a bill-credit plan that only looks amazing at exactly one usage level. So shop carefully.

Commuting Costs: Gas, Tolls, and the Real Price of Your Time

Gas prices

Gas fluctuates, but in the video we referenced it trending around mid-$2.60-ish per gallon in DFW at the time.

Toll roads (a major DFW budget item)

If you commute using SH 121, Sam Rayburn Tollway, or Dallas North Tollway, toll costs add up quickly.

For TollTag users, budgeting about $0.22 per mile is a practical rule of thumb (and it’s consistent with NTTA rate change reporting).

And yes—having a TollTag matters, because pay-by-mail options can be much higher.

Groceries & Dining in Flower Mound: Surprisingly Reasonable (With a Few Notes)

Groceries and dining in Flower Mound, Texas are honestly one of the more pleasant surprises for relocating families—especially compared to what many people expect from an upscale suburb. According to PayScale, grocery prices in Flower Mound run about 9% lower than the national average, and they even provide sample staple pricing like bread, milk, eggs, and bananas to help families sanity-check their budget. That said, your real monthly grocery total still depends on family size and how often you cook at home, so a helpful “realistic planning” benchmark is the USDA food budget range: for a family of four, national averages often land roughly around $1,000+/month on a thrifty plan, with higher-cost plans rising from there based on food preferences and how much you shop organic, premium proteins, or convenience items. In daily life, Flower Mound families typically rotate between nearby grocery options like Kroger, Tom Thumb, and Market Street for weekly runs, then supplement with occasional bulk trips and specialty shopping based on taste and budget. For dining out, Flower Mound and the immediate Highland Village/Lakeside area have a surprisingly strong restaurant scene for families—local favorites frequently mentioned include spots like Verf’s Grill & Tavern, Prime Farm to Table, and 1845 Taste Texas, plus nearby staples in the area like Hillside Fine Grill, Shoal Creek Tavern, and brunch-friendly options like Sip + Savor, Chipotle, Rosa’s Cafe, Chili’s—so you’ve got everything from casual family dinners to date-night restaurants without driving into Dallas. A smart budget line for most relocating households is to plan $900–$1,400/month for groceries (depending on family size and how much you cook at home) and then add a separate dining-out category based on your lifestyle—because in Flower Mound, the “let’s grab dinner” temptation is real (in the best way).

Grocery store reality in Flower Mound

Flower Mound has plenty of options, including a Walmart, Target, Tom Thumb, Sprouts, Kroger and Whole Foods near the Highland Village side.

But here’s the headline everyone asks:

No, Flower Mound does not have its own H-E-B or Trader Joe’s (at least not currently), so many residents drive to nearby areas.

For Costco / Sam’s, expect to drive toward Southlake or Lewisville.

Childcare Costs in Flower Mound: Often the “Second Mortgage”

Childcare is one of the biggest “real life” expenses for families moving to Flower Mound, Texas, and for many households it genuinely feels like a second mortgage—especially if you have an infant or toddler. The reason the monthly numbers can look all over the place is because childcare pricing depends on age (infant vs. toddler vs. preschool), the type of provider (large center vs. Montessori vs. home daycare), and the schedule (2–3 days a week vs. full-time). For example, local childcare pricing data for infant care in Flower Mound shows an average starting rate around $16.43/hour, which comes out to roughly $657/week for a 40-hour week and approximately $2,136/month—and that’s before you factor in optional add-ons like early drop-off, late pickup, or premium programs.

When families look at center-based preschool and early education programs in Flower Mound, the costs often land in a more predictable weekly or monthly structure, but they still add up fast. Some premium education-style centers publish tuition by age—one Flower Mound-area example shows weekly tuition ranging roughly from $395/week for infants down to $350/week for preschool, which works out to around $1,500–$1,700+ per month depending on the classroom and how the month is billed. Other programs price by schedule and extended hours; for instance, one local preschool provider lists 5-day monthly tuition around $1,092 for a school-day schedule and about $1,528/month for extended hours (7:00 AM–6:00 PM), with lower monthly pricing for 2–4 day options. On the more budget-friendly side, some weekday church preschools can be significantly lower—one Flower Mound-area program lists $260/month for tuition (Sept–April), but also notes additional upfront costs like a registration fee and supply fee, which is exactly why families should ask about “all-in” cost, not just the monthly number.

A lot of families relocating to Flower Mound also don’t realize they may have a school-based option once their child is approaching Pre-K age. Lewisville ISD offers early childhood programs, and for families who don’t qualify for free Pre-K, LISD lists tuition-based pricing such as $820/month for a non-eligible student, and reduced tuition for eligible children ($320/month for eligible 4-year-olds and $620/month for eligible 3-year-olds), plus a $220 non-refundable registration fee (with part credited to the first month). The biggest “reality check” in all of this: infant care is usually the most expensive tier, and once you add registration fees, supply fees, and extended-hours pricing, your true monthly childcare budget in Flower Mound can easily land anywhere from the high hundreds to $2,000+ per month depending on your child’s age and your work schedule.

Homeowners Insurance: The Wild Card Cost in Texas

Insurance is one of the biggest “surprise expenses” for people moving to Texas, especially after major weather years.

National average homeowner insurance costs are often cited around $2,110/year, but Texas can be much higher depending on the source and risk profile.

Some Texas-focused estimates can be significantly higher (sometimes several thousand per year), which is why it’s smart to quote insurance before you fall in love with a house.

Translation: in Flower Mound, your insurance cost is highly individualized—home age, roof type, claim history, deductible, and coverage all matter a lot.

The “Lifestyle Costs” That Make Flower Mound Worth It (But Still Cost Money)

A big reason people choose Flower Mound is that your day-to-day life feels easier:

strong parks + trails

family-focused neighborhoods

golf, recreation, community events

quick access to lakeside dining/entertainment pockets

But the lifestyle tends to come with optional (and not-so-optional) spending:

sports + activities (club teams, lessons, camps)

dining out and weekend outings

home upkeep (landscaping, pool maintenance, pest control)

Those aren’t “required”… until you live here for 6 months and suddenly your calendar is full.

Sample Monthly Budget: What a Flower Mound Family Might Spend

Below is a simple planning framework. (Not financial advice—just realistic math.)

Example A: Family buys in the $600K range

Typical monthly categories to plan for:

Mortgage + escrow (PITI): varies by rates/down payment

Property taxes: depends on exemptions + exact area

Homeowners insurance: quote early

Utilities:

Water/sewer/trash: $70–$120

Internet: $60–$90

Electric: commonly $150+ depending on season

Natural Gas (if applicable) $20 to $200 a month depending on season and what uses it.

HOA (if applicable): $20–$50/month (or more)

Commuting (gas + tolls): depends heavily on route and TollTag usage

Child care (if applicable) - $1200 to $2200 a month per child depending on age and needs.

Example B: Family chooses Lakeside luxury condo living

This one can trade yard work for higher monthly fixed costs:

Condo HOA: hundreds to $2,000+/month

Electric, parking, amenities, etc.

It’s a totally different lifestyle—and budget.

How to Lower Your Cost of Living in Flower Mound (Without Sacrificing the Experience)

Here are the moves that genuinely help:

Claim your homestead exemption (and verify your property tax estimate before closing)

Shop electricity plans carefully and avoid “too good to be true” bill-credit traps

Get a TollTag immediately if you’ll use toll roads (DFW tolls punish the unprepared)

Quote homeowners insurance early and compare deductibles and roof coverage options

If childcare is in your world, tour multiple providers and ask about:

registration fees

supply fees

annual increases

sibling discounts

What Salary Do You Need to Live in Flower Mound, Texas?

For most families relocating to Flower Mound, Texas, the household income you need depends heavily on your home price range, property taxes, and whether you’re paying for childcare. Flower Mound delivers a higher-quality lifestyle with strong schools and great amenities, but the trade-off is that housing and property taxes are the biggest drivers of your monthly budget. Since Texas has no state income tax, homeownership costs are heavily shaped by local property taxes, and in Flower Mound your total tax rate typically combines the Town of Flower Mound rate ($0.387277 per $100 valuation) plus Lewisville ISD ($1.1178 per $100 valuation) and additional county/local entities, meaning your full tax bill often lands around the high 1% range to low 2% range depending on location and exemptions.

If you’re trying to hit the minimum entry point into Flower Mound—meaning an older home, smaller townhome, or condo in roughly the $450,000 range—a realistic monthly cost for the full housing payment (mortgage, taxes, insurance, and HOA if applicable) often lands around $3,400 to $4,000 per month, with townhomes and condos usually carrying higher HOA dues than single-family neighborhoods. Once you add real family expenses like utilities, groceries, transportation, insurance/healthcare, and lifestyle spending, most families of four typically land in a total monthly budget around $7,000 to $9,000 per month without daycare, and closer to $8,500 to $10,800 per month if you have one child in full-time childcare. Because of that, a reasonable household income target to live in Flower Mound at the low end is about $115,000 to $150,000 per year without daycare, or about $140,000 to $185,000 per year with one child in daycare.

For the most common relocation scenario, where families are shopping near the median price range around $640,000, the monthly housing cost (mortgage, taxes, insurance, plus HOA if applicable) typically lands around $4,500 to $5,000 per month, depending on interest rates, exemptions, and your exact neighborhood. When you factor in normal family living costs—utilities, groceries, dining out, car payments and commuting, healthcare, kids’ activities, and routine life expenses—most households land around $8,000 to $10,200 per month without daycare and $9,500 to $12,000 per month with one child in daycare. A practical income target for families who want to live comfortably in Flower Mound at this median home level is around $135,000 to $180,000 per year if you don’t have daycare, and about $160,000 to $225,000 per year if you do. If you have two kids in daycare at the same time, that budget reality often pushes the needed household income closer to $185,000 to $260,000 per year, depending on your other debts and lifestyle spending.

For families looking at luxury Flower Mound homes over $1 million, the budget shifts significantly because property taxes increase with the home’s valuation and larger homes usually come with higher utility and maintenance costs. In this tier, total monthly housing expenses commonly fall around $7,000 to $9,000 per month once you include mortgage, taxes, and insurance, and full-family monthly spending often lands around $12,000 to $15,000 per month without daycare, or $13,500 to $17,000 per month with one child in daycare. That means most families realistically need a household income of about $200,000 to $275,000 per year without daycare, and closer to $225,000 to $320,000 per year with daycare, especially if they want to enjoy the lifestyle without feeling financially stretched. Families who want the “extra safe” version—where housing stays closer to traditional affordability guidelines—often plan closer to $275,000 to $350,000+ per year in the luxury tier.

As a clean rule of thumb for your planning, most families can expect the minimum household income to live in Flower Mound to land around $130,000 to $170,000, a comfortable middle-of-the-market income for the median home price to land around $170,000 to $230,000, and a true luxury lifestyle income to fall closer to $250,000 to $350,000+, depending heavily on childcare costs, commuting, and any existing monthly debt.

Final Take: Is Flower Mound Worth the Cost?

For many families, Flower Mound hits the sweet spot: upscale suburban living, strong schools, great safety, and prime DFW access.

The trade-off is simple:

✅ You get lifestyle, location, and stability

💸 You pay for it mostly through housing + taxes (and sometimes insurance)

If you’re considering moving to Flower Mound Texas, the smartest thing you can do is plan the move based on true monthly costs, not just the home price.

Want help narrowing down the “best fit” neighborhoods in Flower Mound?

The right area depends on schools, commute routes, home age, HOA style, and whether you want walkability vs. space. The best part? There’s a Flower Mound option for almost every family vibe—you just want to buy into the one that fits your life and your budget.