Navigating the 2024 Dallas Housing Market: Expert Insights and Forecasts

Summary of Article:

Introduction: Overview of the 2024 Dallas Housing Market Forecast.

Financial Preparedness: Importance of financial stability before buying a home.

Challenges in the Current Market: Low inventory and elevated interest rates affecting buyers and sellers.

Factors Affecting the 2024 Market: Analysis of jobs, inflation, interest rates, and legal/geopolitical issues.

Analysis of Job Market and Economic Outlook: Discussion on job growth and unemployment rates in Dallas-Fort Worth.

Inflation and Interest Rate Trends: Trends in inflation and potential impact on mortgage rates.

Predictions on Interest Rates and Mortgage Rates: Speculation on rate cuts and their implications for buyers.

Considerations for Homebuyers: Advice for navigating market uncertainties and seizing opportunities.

Legal and Geopolitical Factors: Impact of external factors on the housing market.

Predictions and Forecasts: National and local projections for inventory, interest rates, and home prices.

Advice for Buyers and Sellers: Importance of seeking professional advice and understanding market dynamics.

Conclusion: Summary of key takeaways and recommendations for navigating the 2024 Dallas housing market.

The Dallas housing market, like many others, is subject to various economic forces and market dynamics. As we delve into 2024, potential homebuyers and sellers are faced with a myriad of factors to consider before making decisions. In this blog post, we'll dissect the recent trends, forecasts, and expert opinions shaping the Dallas real estate landscape. So is it good time to buy house in dallas? Lets take a look!

Financial Preparedness:

Before diving into the housing market frenzy, it's crucial to ensure financial stability. Elevated interest rates and uncertainties in the economy necessitate having reserves for unforeseen expenses, such as repairs and maintenance. Without a solid financial foundation, the dream of homeownership could quickly turn into a financial burden. Prospective buyers should assess their debt-to-income ratio, credit score, and overall financial health before considering purchasing a home.

Challenges in the Current Market:

One of the primary challenges plaguing the Dallas housing market is the low inventory of available homes. This scarcity poses difficulties for both buyers and sellers, with elevated interest rates further complicating matters. Prospective buyers find themselves facing higher mortgage rates compared to previous years, adding strain to their finances. Additionally, competition among buyers for limited inventory often leads to bidding wars, driving prices higher.

Fannie Mae Study on the “Lock In Effect” Sellers are experiencing keeping them from selling their home

Factors Affecting the 2024 Market:

Several key factors influence the trajectory of the housing market in 2024, including jobs, inflation, interest rates, and legal/geopolitical issues. Understanding how these elements interact is essential for making informed decisions in real estate transactions. Each of these factors contributes to the overall sentiment and direction of the housing market, impacting both supply and demand dynamics.

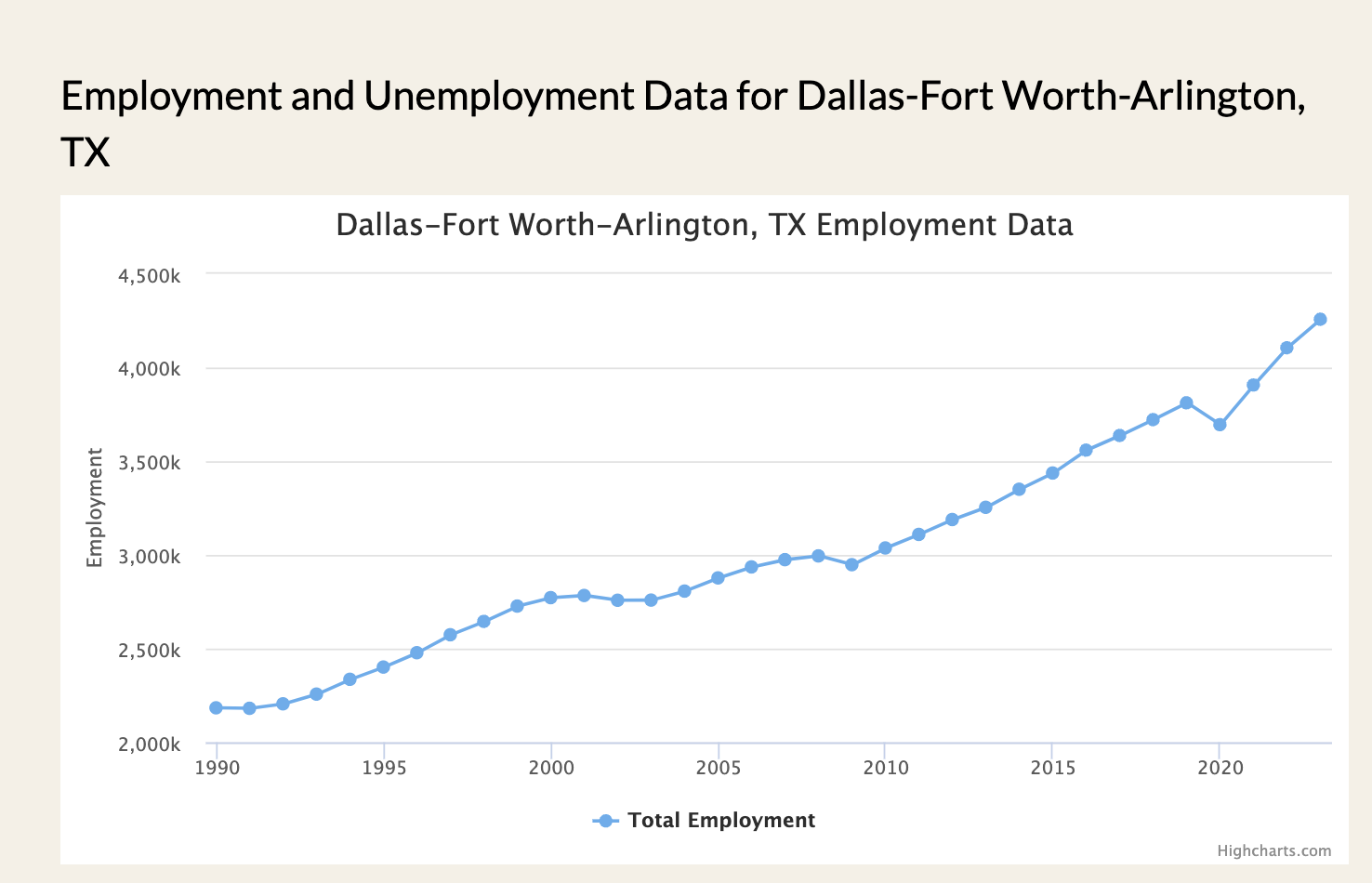

Analysis of Job Market and Economic Outlook:

Despite global uncertainties, the job market in the Dallas-Fort Worth area remains robust. Reports indicate steady job growth rates and unemployment rates lower than the national average, painting a picture of a thriving local economy. Job stability and income growth are critical factors driving demand for housing, as individuals seek homeownership as a means of wealth accumulation and stability.

Dallas Fort Worth Employment Statistics from Texas Workforce Commission

U.S. Bureau of Labor Statistics Twelve Largest Metro Areas Net Employment Growth

Inflation and Interest Rate Trends:

The trend of decreasing inflation rates provides a glimmer of hope for potential homebuyers. As inflation eases, there's speculation that the Federal Reserve might consider rate cuts, potentially impacting mortgage rates and borrowing costs. Lower interest rates could stimulate housing demand by making mortgages more affordable, thereby bolstering home sales and prices.

Consumer Price Index as of January 2024 - Inflation Down to 3.1%

Predictions on Interest Rates and Mortgage Rates:

While forecasts suggest the possibility of rate cuts by the Federal Reserve, uncertainties loom large. Experts caution against banking solely on rate reductions and advise buyers to consider the broader market dynamics before making decisions. Mortgage rates are influenced not only by central bank policies but also by investor sentiment, economic indicators, and global market conditions.

Excerpt from Forbes article discussion Interest Rate Cut Estimates for 2024

FED Funds Rate Projections for 2024

Considerations for Homebuyers:

For individuals contemplating homeownership in 2024, it's essential to gauge the market sentiment carefully. While challenges exist, seizing opportunities when they arise could prove beneficial, especially if rates begin to drop. Buyers should evaluate their long-term financial goals, housing needs, and risk tolerance before entering the market. Additionally, working with a knowledgeable real estate agent can provide valuable insights and guidance throughout the home buying process.

Legal and Geopolitical Factors:

External factors such as elections, legislative changes, and geopolitical events can significantly influence the housing market. Staying informed about these developments is crucial for anticipating potential impacts on real estate transactions. Changes in regulations or geopolitical tensions can create uncertainty, affecting buyer and seller confidence and market activity.

Predictions and Forecasts:

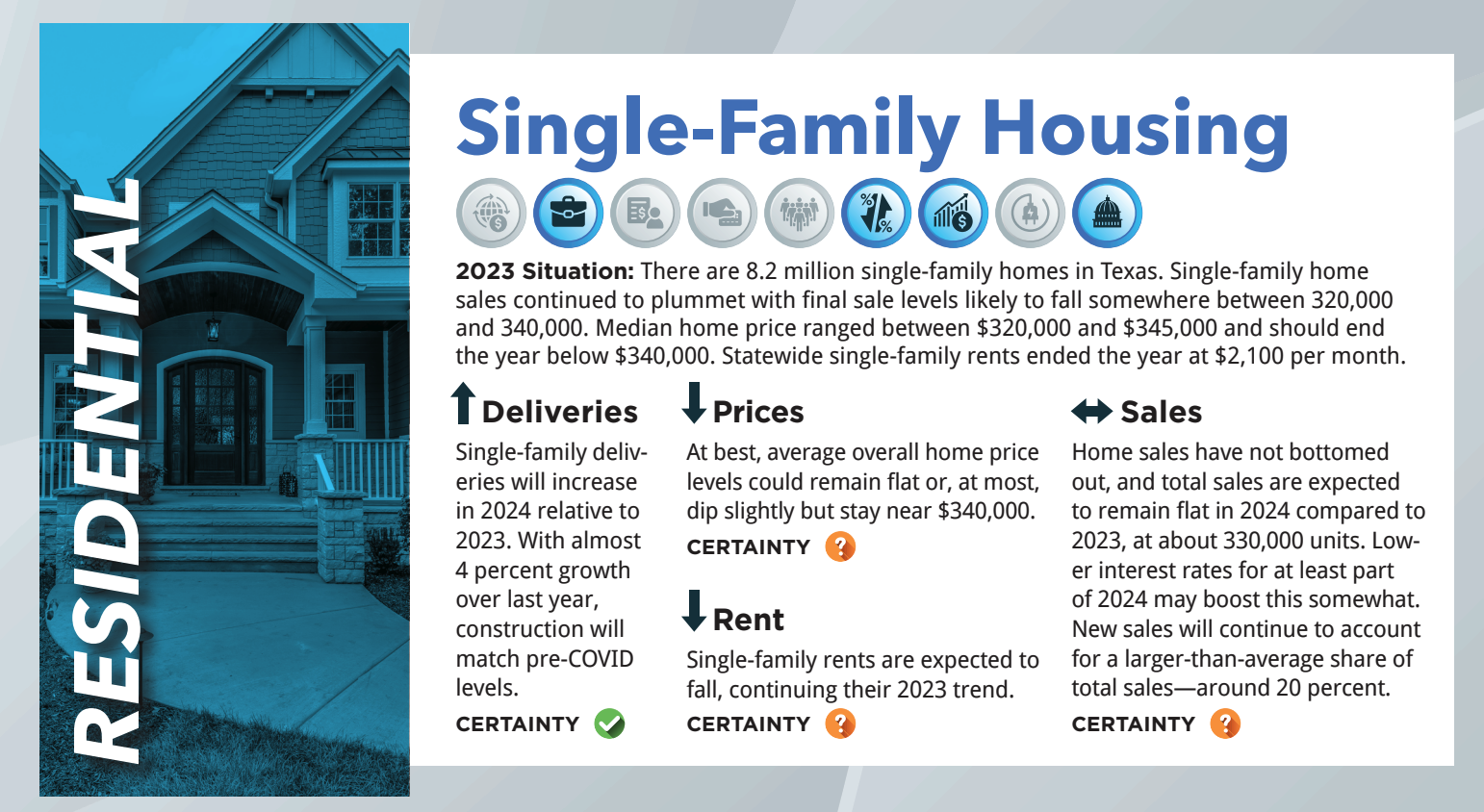

National and local forecasts provide valuable insights into the future of the Dallas housing market. Projections on inventory, interest rates, home prices, and sales trends offer guidance for buyers and sellers alike. While forecasts can provide a general outlook, market conditions are subject to change based on various factors, making it essential to monitor developments and adapt strategies accordingly.

National Association of Realtors National Housing Forecast for 2024

Texas A & M Texas Single Family Housing Forecast for 2024

Dallas Texas Housing Market Historic Performance since 2013 to Present

Advice for Buyers and Sellers:

In navigating the complexities of the 2024 housing market, seeking professional advice is paramount. Whether you're a first-time buyer or a seasoned investor, understanding market dynamics and making informed decisions is key to success. Real estate agents can offer personalized guidance based on their expertise and market knowledge, helping buyers and sellers navigate transactions with confidence.

As we traverse the uncertainties of the 2024 Dallas housing market, knowledge is our greatest asset. By staying informed, adapting to market changes, and seeking expert guidance, buyers and sellers can navigate the real estate landscape with confidence and clarity. While challenges and risks exist, opportunities abound for those who approach the market with diligence and strategic planning.